M&G英卓 投資管理:

美政策風險升 分散投資至歐亞股

中美兩國有望開展貿易談判,利好全球投資氣氛,上周恒指上升523點或2.38%,美股三大指數道指、標指及納指均上漲近3%,今期封面故事由M&G英卓投資管理股票、多元資產及可持續發展首席投資總監Fabiana Fedeli、多元資產投資總監Michael Dyer及固定收益首席投資總監Andrew Chorlton分析最新形勢。Fedeli認為,由於美國政策不明朗因素持續,可從美股分散投資至歐洲及亞洲股市;Dyer則指出,旗下多元資產基金在上月前已經減持中國股票,現擬等日後股價回落至更吸引水平始低吸;Chorlton則指出,目前美國國債的避險功用已不及過往,不少投資者因此已考慮轉投英國以至歐洲國債。明報記者 葉創成

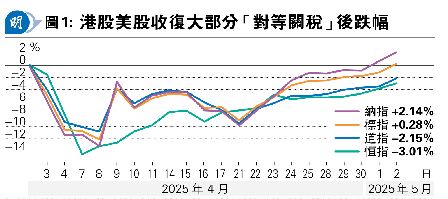

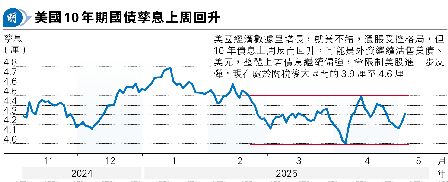

雖然美國總統特朗普上月2日美股收市後公布「對等關稅」措施後,市場對當地以至全球經濟衰退憂慮均升溫,觸發美股跟着幾日曾顯著調整,港股亦不能倖免跟隨大跌,惟隨着上月9日特朗普突然轉為宣布將對中國以外國家的「對等關稅」暫緩實施90天,美股過去三個多星期已掉頭回升,三大指數道指、標指及納指上周便分別上升3%、2.92%及3.42%,後兩者更已升穿公布「對等關稅」前、上月2日收市價,表現強勁;而恒指上周亦上升523點或2.38%,連升三周,像美股道指一樣已經收復上月初跌浪的大部分失地(見圖1),表現亦頗理想。

每年5月往往屬全球股市淡季,市場亦有「五窮月」及「5月沽貨後離場」(Sell in May and go away)等說法,雖然由於本港、美國以至全球股市踏入5月首周後,在上周均向好,上述傳統智慧暫時未有應驗,惟美國「對等關稅」措施帶來不明朗因素對股市的影響是否真的已雨過天晴呢?今期封面故事首先由去年11月初美國總統大選前已超配中國股市、低配美股標指,至今測市準確(見配稿)的M&G英卓投資管理Fabiana Fedeli就此分析。

即使美股波動增 亦要保持投資

Fedeli指出,從美股過去一個月的波動可見,市場情緒可以變化得很快,在此情况下,假如投資者希望捕捉大市升跌(timing the market)、低買高賣並不容易;而且分析過去20年美股數據,每年平均回報為8.2% ,雖然屬表現不錯,惟假如錯過了其中表現最好的20個交易日,每年平均回報便大幅下跌至約1%,由此可見保持投資(staying invested)的重要,即使面對市場不確定,保持投資也屬必須。

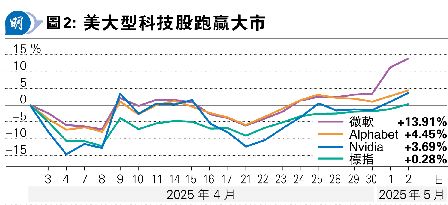

不過,Fedeli分析,在現時美國政策不明朗的情况,美國航空(美:AAL)及達美航空(美:DAL)等多間當地企業已經撤回業績指引,這並不是因為這些公司本身財政有問題,而是管理層無法預測政策將如何演變,這也導致投資者轉為集中追捧業績較可預測的幾隻大型科技股(見圖2),令市場寬度再次收窄。

上月趁跌市低吸日股英國債

美股以外,Fedeli認為可以留意歐洲股市,原因是德國基建投資刺激經濟政策及重新聚焦提升競爭力,已經開始吸引資金流入;個別亞洲股市亦有吸引力,原因是基本因素改善,可望引領估值上調。Fedeli強調,投資者目前投資歐洲及亞洲股市,不只是為了在美股以外分散投資,而是其本身亦具備吸引力,可望帶來理想回報。

Fedeli的同事、M&G英卓投資管理多元資產投資總監Michael Dyer接受訪問時則指出,目前對於全球資產配置者來說,如何因應宏觀事件的發展作出適當的資產配置屬一大挑戰,而該行的多元資產投資組合早於上月開始時已經採取保守策略,包括低配美股、超配存續期長債券(long duration in fixed income)及持有適量現金,因此上月2日美國公布「對等關稅」措施令全球股市出現波動後,上述投資組合表現仍然具備韌性,而且有空間進行可戰術性資產配置轉變,例如增持受惠企業改革的日本股票,以及已反映供應增加為估值帶來壓力的英國國債。

安全資產地位降 適度低配美元

在上月第二周,美匯指數由103.023點大幅回落至最低報99.014點,收報100.102點,按周仍大跌2.84%,普徠仕多元收益債券策略聯席基金經理鍾曉陽在《Money Monday》第494期(上月14日出版)封面故事分析,由於美國今年經濟衰退概率上升,市場當時預期聯儲局全年將減息4至5次合共1厘至1.25厘,換言之,聯邦基金利率上端料由目前的4.5厘回落到3.25厘至3.5厘,指減息預期升溫此因素屬不利美元匯價。

Dyer在是次訪問亦透露,目前旗下多元資產投資組合適度低配美元(moderately underweight USD),反映在美國政策不明朗的情况下,美元作為安全資產的地位可能下降。

去年1月低吸後 近月已高位減持中國股市

另外,值得注意的是,Dyer透露,去年1月恒指於15,000點附近低位徘徊時,旗下多元資產投資組合開始積極增持中國股票,令中國股票去年4月佔組合比例達15%,而隨着港股過去一年多以來反覆回升,包括今年1月中至3月中曾出現強勁升浪,該組合亦已在高位減持中國股票(見圖3),目前中國股票佔組合比例約6%。

Dyer表示:「去年1月很多投資者大舉拋售中國股票,故此中國股票估值亦跌至很低,為我們帶來低吸的機會。當時要在中國股市大跌時積極吸納並不容易,原因是在市場上同樣看好的知音人不多,我們逆市低吸時並不感舒服,但市場往往便是在這些時間見底的;作為比較,假如我們在會見投資者時,每個人都說更美好的事即將發生,屆時便可能便是市場頂部,而我們的工作便是要保持逆向思維低買高賣。」

外圍環境現難預測 對中國股市趨保守

根據Dyer的分析,目前投資中國股市的挑戰是,外圍環境將可以向好或向壞發展,現時難以就此作準確預測,而假如向壞發展的話,股市當然會有進一步調整的壓力。

Dyer表示:「我們一般會以市盈率來為股票估值,即股價等於每股盈利乘市盈率,而在當前不明朗的外圍環境下,中國股票未來的每股盈利到底是多少呢?假如一切回復正常,未來的每股盈利也會正常,目前的市盈率的確屬有吸引力;但假如未來事情向壞的方向發展,未來的每股盈利也會受到影響。由於我們真的不知道事情將會如何發展,故此我們現時傾向稍為保守一點。」

倘中國股市再被拋售 將再積極增持

不過,Dyer亦強調,目前中國股市估值對比全球其他股市屬偏低,故此仍然有一定吸引力,而旗下多元資產投資組合中,中國股票現時佔約6%,指這是有意義的持倉。Dyer表示:「我們目前予全球股市中性評級,當中,比較看好估值較低的地區。」

Dyer總結,假如中國股市日後再像去年1月般出現投資者大舉拋售的壓力,令估值再次跌至明顯偏低水平,M&G英卓投資管理作為逆向投資者,又會積極吸納中國股票,屆時旗下多元資產投資組合的中國股票佔比料回升到10%至15%。