美今年料再減息 標指年底最牛見6800

港股恒指上周上升69點或0.27%,變動不大,市場焦點是美國聯儲局主席鮑威爾於本港時間上周五晚上在Jackson Hole年會發表講話指當地就業市場面臨的風險正在上升,投資者預期下月減息機率上升,美股三大指數道指、納指及標指當日升幅均逾1.5%,恒指夜期亦高水383點,收報25,722點,逼近今年高位,今期封面故事由富蘭克林鄧普頓研究所投資策略師陳夏儀分析最新形勢。陳夏儀預測,因應美國就業市場轉弱,聯儲局在今年餘下時間將減息一至兩次,而期內GDP料保持增長,有利標指成分股全年盈利增長5%至10%,帶動標指在今年底達到6400點至6800點。她續說,今年以來去全球化加快,減低對美元需求,料美匯指數跌勢持續,這利好亞太股市,而目前該行認為中國股市仍有不少投資機會。

明報記者 葉創成

美國就業市場的變化屬本月以來的焦點,背景是當地勞工統計局本月1日公布,上月新增非農業職位只有7.3萬個,而且此前兩個月淨修訂高達25.8萬個——其中5月新增非農業職位從14.4萬個大幅下調至1.9萬個,6月從14.7萬個下調至1.4萬個,均遠低於近年的新增職位水平,而且上月失業率亦已從4.1%上升至4.2%(見圖1),上述數據顯示當地就業市場明顯降溫後,總統特朗普當日便形容數據「被操縱」,即時解僱勞工統計局長麥肯塔弗(Erika McEntarfer),而近月一直被特朗普要求減息的聯儲局主席鮑威爾上周五在Jackson Hole年會發表講話,也認為當地就業市場風險正在上升,似乎為香港時間下月18日凌晨宣布減息鋪路。

鮑威爾表示:「雖然勞動力市場整體看似平衡,但這種平衡很奇特,源於勞動力供應及需求均顯著放緩,這種不正常情況預示就業面臨下行風險正在上升,一旦這些風險成為現實,可能迅速以裁員人數明顯增加和失業率上升的形式呈現(Overall, while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.)。」

美GDP半年只增1.2% 受累消費開支減慢

在鮑威爾是次Jackson Hole的演講稿的附註中,也有解釋美國5月及6月新增職位淨修訂至大幅下調25.8萬個的原因,指有關修訂來自廣泛私營行業、州政府及地方政府,特別是在教育領域向下修訂較多,指這反映調查所得的更多數據及對季節性因素的重新評估。

鮑威爾在是次Jackson Hole的演講中又指出,美國今年上半年GDP按年只增長1.2%,是去年全年GDP增長率2.5%約一半,認為GDP增長放緩大致上反映當地消費者開支減慢(The decline in growth has largely reflected a slowdown in consumer spending)。

可以留意的是,中金公司研究部執行負責人楊鑫在《Money Monday》第508期(上月21日出版)封面故事已指出,美國消費市場正放緩,故當時她建議留意這對當地上市公司帶來的影響,上述專訪見報以來美國大型零售股Target Corp(美:TGT)股價逆市下跌逾4%,而鮑威爾上周五在Jackson Hole上也表示當地消費者開支減慢,可見楊鑫測市準確。

美加徵關稅對通脹影響 須更長時間觀察

鮑威爾在是次Jackson Hole的演講中也指出,特朗普近月加徵關稅對美國消費品價格帶來的影響現已顯而易見,並且預期有關影響在未來幾個月會繼續累積,而影響持續多久及多大則屬未知之數,而聯儲局制定貨幣政策時關注這會否大幅提升持續存在通脹問題的風險( materially raise the risk of an ongoing inflation problem),他表示:「一個合理的基準預測是關稅對通脹帶來的影響屬相對短暫──類似一次性的價格水平調整(a one-time shift in the price level),但『一次性』並不代表『全部即時生效』(all at once),因此仍然需要更長的時間觀察供應鏈及零售網絡到底如何應對被加徵關稅。另外,關稅稅率也繼續發生變化,這可能會令價格調整期延長。」

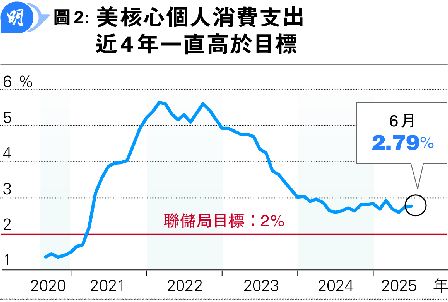

美通脹過去4年均超標 長期通脹預期仍受控

雖然美國自從2020年首季新冠疫情大爆發後,當地經濟在2021年復常以來,至今逾4年聯儲局視為通脹指標的核心個人消費支出(Core PCE)一直高於當局2%的目標(見圖2),鮑威爾在是次Jackson Hole的演講中承認上述問題的同時,亦提到調查結果顯示,市場對長期通脹受控仍然維持信心,這與當局預料長期通脹將處於2%的觀點屬一致。

不過,鮑威爾也提醒,不可把市場對長期通脹受控有信心視為理所當然,需要提防加徵關稅導致一次性的價格水平調整,演變為持續存在通脹問題。

鮑威爾稱或需調整政策立場 下月減息機率75%

綜合上述分析,鮑威爾認為,短期來說,美國通脹面對上行風險,而就業市場則面對下行風險,承認這是一個有挑戰性的處境,但他也補充,目前聯儲局的貨幣政策處於緊縮區域,而基本前景和風險平衡的變化可能需要當局調整政策立場(with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.),似乎為短期內進一步減息開綠燈。

根據FedWatch網站上周六數據,在聯儲局下月18日議息會議上,有75%機率減息0.25厘,另有25%機率維持利率不變。

美就業市場已轉弱 放寬幣策屬適當

富蘭克林鄧普頓研究所投資策略師陳夏儀上周在媒體圓桌會議則預測,美國今年GDP料按年增長1.5%,即使對比去年屬增長放緩,但距離衰退仍然很遠,因此整體而言仍屬積極向好。

根據富蘭克林鄧普頓研究所的預測,美國失業率將由上月的4.2%升至年底的4.5%至4.75%。陳夏儀也認為,美國就業市場現時的確比較弱,即使當地通脹仍未回落至2%的政策目標,但聯儲局已處於適當時機進一步放寬貨幣政策,預期當局今年可能會減息一至兩次。

至於上述美國宏觀經濟及貨幣政策變化對當地股市有何影響呢?陳夏儀分析指出,假如美國今年GDP如上述預測按年增長1.5%的話,已經可以支持標指成分股盈利上升5%至10%,再加上聯儲局料快重啟減息周期利好當地股市,故她預測標指今年底將達6400至6800點。標指上周五收報6466點,按《Money Monday》計算,若年底標指達6400至6800點,潛在變幅為-1.02%至5.16%。

Magnificent 7今年來跑輸標指 趨勢料持續

至於美股如何選股呢?可以留意的是Nvidia(英偉達)(美:NVDA)、微軟(美:MSFT)、蘋果(美:AAPL)、Google母企Alphabet(美:GOOG)、Meta(美:META)、亞馬遜(美:AMZN)及Tesla(美:TSLA)等美國7隻龍頭科技股(Magnificent 7)整體股價在前年及去年大幅跑贏大市後,今年以來Magnificent 7整體股價只上升9.81%,與標指期內上升9.95%比較,屬略為跑輸大市(見圖3)。

陳夏儀表示,目前她也比較看好Magnificent 7以外的美股。