港地產股未宜吸 小心價值陷阱

Portwood Capital董事總經理卓百德(Peter Churchouse)在上文認為,本港料下月開始跟隨美國減息,可望抵消本港經濟所面對的不少逆風,有利樓市出現「U形」復蘇,即使這樣,他並不建議現時便買入本港地產股,指該板塊估值偏低的情况可能仍會持續,有些投資者或會視此為價值陷阱(value trap)。

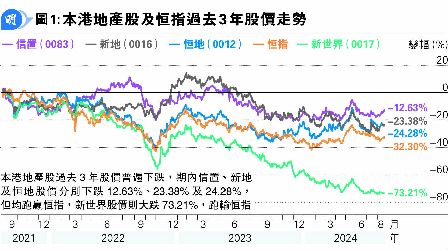

隨着本港住宅樓價2021年第三季以來下跌逾兩成,加上本港寫字樓及商舖期內估值亦跟隨租金下滑,本港地產股過去3年股價普遍下跌,期內信置(0083)、新地(0016)及恒地(0012)股價分別下跌12.63%、23.38%及24.28%,但均跑贏恒指,而新世界(0017)股價則大跌73.21%,跑輸恒指(見圖1)。

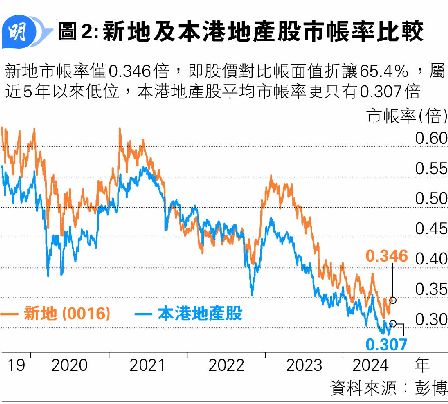

以新地上周五收市價71.85元計算,市值2082億元,在同業中屬最高,而根據彭博數據,新地市帳率僅0.346倍,即股價對比帳面值折讓65.4%,估值屬近5年以來低位,而且本港地產股平均市帳率更只有0.307倍(見圖2),估值更吸引,記者在是次專訪中請教Portwood Capital卓百德,新地以至本港地產股是否可以低吸呢?

估值偏低已一段時間

或仍持續

卓百德表示,目前本港地產股估值非常接近歷史低位,以股價對比資產淨值折讓70%評估的話,即投資者以30元買入某隻地產股,便可以買到其持有的100元淨資產,理論上這是有吸引力的,但也要留意的是,估值如此低的情况已持續一段時間,有些投資者或會視此為價值陷阱。

中國股市與本港住宅樓價均於2021年見頂,過去3年反覆回落至今,卓百德認為,國際投資者現傾向低配所有中國資產,當中包括本港股票及物業,背景是地緣政治風險升溫及內地經濟增長放緩等,令持有中國資產風險增加。他表示,雖然目前難以估計國際投資者何時才會改變低配中國資產的策略,但近日有些國際投資者已重新關注新興市場,原因是美股估值已非常昂貴,而美股是過去20年為國際投資者取得最佳回報的資產。

歐美若改對華貿易政策

外資或返中國股市

卓百德表示,中國資產表現過去3年大幅跑輸歐美同類資產後,假如歐美國家領導人出現改變,令全球貿易動能、規則及限制(global trade dynamics, trade rules, trade restrictions)也出現改變的話,便是催化劑吸引國際投資者重投中國資產,當中包括本港股票及物業。

根據卓百德的分析,隨着美國聯儲局於今年9月開始減息,本港亦會跟隨減息,雖然本港減息對樓市屬好消息,但即使這樣,也難以令樓市出現真正復蘇,需要本港經濟好轉,樓市才具備足夠條件持續向好。由於本港經濟近年與內地經濟關連性愈來愈強,若內地經濟重拾增長動力及房地產市場回穩,對本港經濟好轉屬非常有利。