加經濟與加息預期

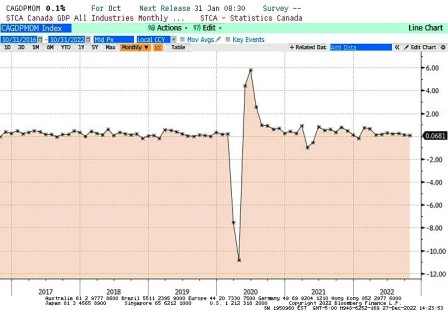

加拿大10月份和11月份經濟增長都是0.1%(圖一),9月份增長調高至0.2%。三個月合計使到加拿大第四季增長將會達到1.2%,高於加拿大中央銀行先前預測的0.5%。10月份經濟增長主要來自服務業(+0.3%)──批發、運輸、藝術及娛樂,居住及食品服務;壓低增長的是製造業(-0.7%),包括採礦、能源以及製造業。彭博經濟師調查預期2023年第一二季會出現負增長,進入技術性衰退。隔夜指數掉期原先預測中央銀行會維持利率不變,但經濟數字公布之後加息機會變成50/50。經濟數字的情況使到經濟師對加拿大中央銀行下一步行動有不同意見。

帝國家銀行認為,就業數字以及加拿大中央銀行本身所作的商業及消費調查,比國內生產總值在制定利率政策時更為重要。道明銀行認為高於預期的增長及持續核心通脹的壓力會使到中央銀行感到不安。Capital Economics預測一月份還會加息25點子然後央行就會停步。

Desjardins分析11月份的預覽預測顯示經濟基本上沒有增長,而Capital Economics的分析師則指10月份經濟增長是受到一些一次性因素影響。多倫多藍鳥進入季後賽和多了補充賽事,以及冰球賽事入場人數增加(受到球季延遲開始影響)使到藝術及文化娛樂增長了2.2%。公營事業增長0.6%反映了9月份因為英女王逝世放假之後回到正常工作時間的影響。因此10月份的增長只是因為特別因素,經濟增長在2023年預期會收縮。居住及食品服務增長1%是因為相對於上一個月餐廳業務抵消了酒店業的疲弱。航空運輸上升5.5%,但比疫情之前仍然下降了34%。

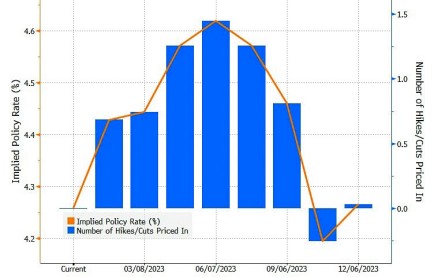

加拿大中央銀行將會在1月25日召開會議,現時市場折現央行加息幅度(圖二)只有17.8點子,意思就是中央銀行很有機會不加息。市場折現加拿大終點利率是4.59%,比起現時政策利率4.25%相差只有34點子。市場估計利率高峰是在半年之內出現,由1月至6月之間加拿大中央銀行還有四次會議,那意味着如果以每次加息25點子計算,中央銀行只會再加息一至兩次。