英譯概念:Electronic payment

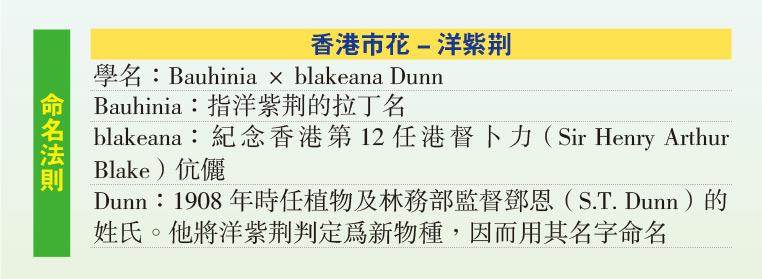

【明報專訊】Electronic payment methods include credit cards and e-wallets. The latter include Stored Value Facility (SVF) schemes issued by a number of SVF licensees, such as Octopus, AlipayHK and PayPal.

Maaike Steinebach, CEO of Visa Hong Kong & Macau, said that the COVID-19 pandemic and the Hong Kong government's launch of the electronic Consumption Voucher Scheme had change consumers' habits and behaviours. There is also a report showing that Hong Kong merchants and consumers are ready for the widened use of electronic payments.

Rita Li, Sales and Marketing Director of Octopus Cards Limited, said that Octopus users accounted for the largest amount of consumption in supermarkets and department stores, and the biggest increases in the volume of consumption were driven by electronic products, hotel and catering. For electronic products, the amount of money spent in every transaction generally exceeded $1,000. The Consumption Voucher Scheme had visibly increased market stall owners' acceptance of electronic payments. Some stall owners said that they would take note of the usage of electronic payment during the Consumption Voucher period and then consider whether to renew the lease of their card readers after the end of the Voucher Scheme. However, a stall owner who sold mountain herbs at Tai Po Hui Market under the Food and Environmental Hygiene Department (FEHD) said in 2020 that there was not even a cash register in her stall, and it was a lot of hassle to "press a few more buttons" for a transaction that was worth just a few dollars. Furthermore, most of her customers were old ladies in their 70s, and none of them knew how to pay with Octopus cards.

■Mock examination question

With reference to the source, analyse the pros and cons of electronic payment. (8 marks)

Pros

Increase transaction efficiency

Electronic payment can increase transaction efficiency. It can save time for preparing change and payment settlement. An electronic payment system can digitise transaction data and transaction process, which can help companies reduce manual handling of accounts, reduce operating costs and improve the business environment.

Reduction in cash-borne disease

Viruses can be transmitted indirectly through cash. The widespread use of electronic payment will help reduce the risk of cross-transmission in cash transactions and help maintain overall public health.

Cons

Increase operating costs

For individual small merchants, the use of electronic payment will increase the cost of operation. Some merchants in wet markets, for example, will need to purchase Internet devices and install electronic payment terminals. For them, it will not be cost-effective to adopt electronic payment, and their income might actually decrease.

The grassroots may not benefit

The use of electronic payment requires users to have a certain level of information technology literacy and basic Internet equipment such as smart phones. Elderly and grassroots families with low socioeconomic status and information technology capabilities might not benefit from electronic payment, and might actually be worse off if they do not have devices with electronic payment functionality.

(本刊刊出的文章若提出批評,旨在指出相關制度、政策或措施存在錯誤或缺點,目的是促使矯正或消除這些錯誤或缺點,循合法途徑予以改善,絕無意圖煽動他人對政府或其他社群產生憎恨、不滿或敵意。)

[智學公民 第055期]