美11月通脹6.8% 39年最高仍低於投資者預期 股市升

標普再創新高 Oracle股價飈15.6%

【明報專訊】儘管美國11月通脹飈至39年來高點,標普500指數星期五仍上漲0.95%,再創歷史的新高,收市報於4,712.02點,結束美股強勁反彈的一周。道瓊斯工業平均指數漲216.30點,或0.6%,收報於35,970.99點。科技股為主的納斯達克綜合指數漲0.7%,收於15,630.60點。

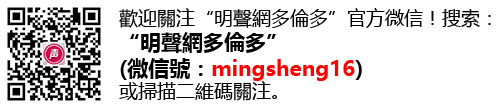

道指自周一以來上揚4%,結束連4周跌勢,錄3月以來表現最佳一周。標普500指數和納指本周分別上揚3.8% 和3.6%,均錄2月以來表現最佳一周。勞工部周五表示,美國11 月份通貨膨脹率同比飈升 6.8%,達到 1982 年以來的最高水平。道瓊斯調查的經濟學家預期通脹率為6.7%。消費者物價指數(CPI)上升0.8%。

去除食物和能源後的核心CPI上升0.5%,同比上升4.9%,與經濟學家預期同。

被譽為全球最成功債券投資機構DoubleLine的行政總裁岡拉克(Jeffrey Gundlach)表示,一些投資者可能預期更為熾熱的通脹數字,但勞工部公布11月份的通脹率後令他們鬆了一口氣,股市亦上漲。

周五的CPI數字可能是數十年來最高,但並未超過預期。LPL Financial首席市場策略師迪特瑞克(Ryan Detrick)表示,這是一件好事情,因為市場定價早已將較高的通脹率考慮進去,因此11月的通脹率可以被視為一種解脫。

迪特瑞克表示,CPI報告中一個亮點是二手車,住宿和機票的漲幅都低於預期。這些部份的通脹始終居高不下,11月的情形可以被視為通脹可能已達頂峰。

投資者也曾擔憂高通脹率可能會令聯儲局加快縮減每月購買1,200億美元債券的計劃。

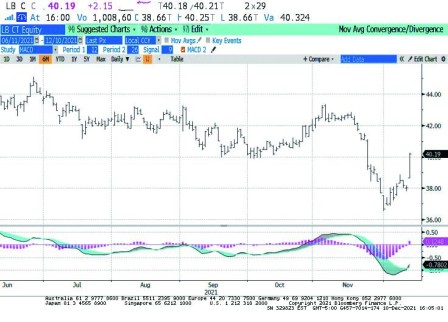

Oracle股價周五上漲15.6%。該公司周四公布的季度財報較預期為佳。

航空股周五下跌。西南航空(Southwest Airlines)跌近3.8%。該公司股票評級再被降級,這次是高盛集團(Goldman Sachs)將其股票評級降級。

互動健身公司 Peloton 雪上加霜,在周四下跌 11.3% 後,周五再跌約 5.4%。瑞信(Credit Suisse)調降對該公司的評級,稱重返健身房和消費者支出的轉變將影響其盈利能力